Our experts will reply you with a quote very soon

What is Personal Loan

Simply put, it is an unsecured loan taken by individuals from the Banks or NBFCs to meet their personal needs. It is provided on the basis of key criteria such as Income level, Credit Score, Employment History and Repayment Capacity, etc. Unlike a Home or Car Loan, a personal loan is not secured against any assets. As it is unsecured and the borrower does not put up collateral like Goods or Property to avail it, the lender in case of default, cannot auction anything you own.

Therefore, their interest rates on personal loans are always higher than those on Home, Car, or Gold Loans when sanctioning them. However, like any other loan defaulting on a personal loan is not good as it would reflect in your credit report and cause problems when you apply for credit cards or any other loans in the future. Banks offer a huge range of personal loan schemes such as SBI personal loan for Salaried, SBI personal loan for professionals like Doctors, Personal loan for Pensioners, HDFC Bank Personal loan for Central Government Employees.

We at LoanPakka offer personal loan of various Banks & NBFCs to compare & choose cheapest among all for our customers of various categories like salaried, self employed, professionals etc.

BENEFITS OF PERSONAL LOAN

Personal loan as compare to other loans has its own features and benefits as given below

Multipurpose Use

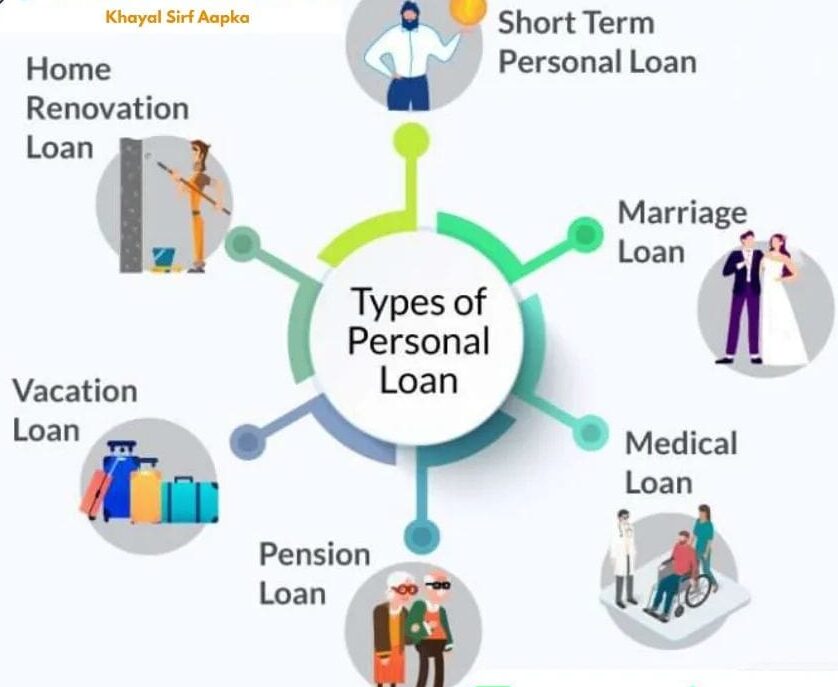

Being multipurpose in nature, it is a most desirable option in terms of financial product. As compared to other types of loan, it can be used for various purposes like renovating your home, marriage related expenses, a family vacation, meeting unexpected medical expenses or any other emergencies.

Unsecured Loan (No Guarantee Required)

The online personal loan is an unsecured loan which means that the borrower does not have to provide any collateral to the lenders. You don’t have to explain to the Bank that where you want to use the personal loan amount.

Quick Approval

Since less documentation is required, they get instant approval from source bank. Personal loans are quickest & easiest to get approval as compared to other loans.

Less Documentation

To avail personal loan, you have to give very less documents unlike home loans. Therefore, it takes less time to get the personal loan.

PERSONAL LOAN ELIGIBILITY

Every Bank or NBFC providing personal loan have different eligibility requirement and needs. Still there are some common criteria for all the Banks & NBFCs. Before applying it is advisable to check eligibility on Eligibility Calculator.

1. Age

3. Minimum Net Income (monthly)

2. Creadit Score

4. Employment Type & Work Experience

Personal Loan (Documents Required)

- Pan card.

- Residence Proof- Aadhar, Passport, Driving License, Voter ID, Utility Bills & To Whomsoever Concern.

- Identity and Age Proof.

- Bank Statement (for last 6 months).

- Salary Slips of last 3 months.

- Completely filled personal loan form & photographs.

- Form 16 or ITR of last 3 years.

Points to Compare before you apply Personal Loan

Compare Interest Rates

It is always good to compare the offers of various Banks and NBFCs before you settle for one. Check and compare the interest rates on personal loan offered by various Banks and NBFCs to get the best and cheapest interest rates on LoanPakka. Most Banks offer completely fixed rate of interest for the entire tenure of the loan. Make sure that the personal loan that you are taking is also fixed for the entire tenure.

Compare Processing Fees

Compare various banks processing fees on the personal loan they offer. Most of the banks have processing fees ranging from 0.5 % to 3 % of the loan amount. Higher processing fees can result in significantly high cost on loan hence, it is important to compare rates for personal loan for central government employees, Personal loan for salaried, Personal Loan for Professionals on LoanPakka and select the best offer.

Insurance Premium

Some Banks or NBFCs may request you to get the insurance policy as it is an unsecured loan. Get the insurance policy which gives you adequate coverage at lowest premium.

Prepayment and Foreclosure charges

Everyone wants to repay his loan as soon as possible. Sometimes, you want to repay part of the loan i.e. part prepayment or you may want to repay entire loan amount before tenure. Banks levy prepayment or foreclosure charges ranging from nil to 5 %. Hence, it is important to compare prepayment and foreclosure charges of various banks on Loan4fauji

FREQUENTLY ASKED QUESTIONS ON PERSONAL LOAN

Low EMI offers can typically result from a long repayment term, a low interest rate, or a combination of both factors. Thus, sometimes you may end up paying more interest to your lender if you choose low EMI. So use online tools like personal loan EMI calculator to find out your interest pay-out over the loan tenure & your repayment capacity before taking a loan.

Yes, you can apply for a personal loan either yourself or together with a co-applicant (jointly), who need to be a family member like your spouse or parents. Having a co borrower mean your loan application will be processed in a higher income bracket, making you eligible for a larger loan amount. However, keeping in mind that if you or the co-applicant has a poor credit history, the chances of success of your application may be less.

Although personal loan usually have no tax benefits. But if you take one for home renovation down payment, you may be eligible for IT deduction under section 24. However this tax benefits is limited to only the interest, not the principal amount. Also, to claim deduction you will have to furnish proper receipts

A major portion of your initial EMI, is actually used to pay off the interest due on your loan. This process is called “front loading”, hence only a small portion of the principal is paid off initially. As you progress further with your EMI’s, these small decreases in the principal amount add up, leading to a decrease in the interest charged on the outstanding amount. A larger portion of the EMI is thus used to pay off the loan principal is later years.

Credit card loan is an offer that you may be able to avail on your card. Such a loan is only applicable to specific cards & you can only approach your card issuer for a loan on it. When it comes to a personal loan, on the other hand, you can approach any lender. Moreover, unlike personal loan application, card loan don’t required any additional documentations.

A higher credit score indicates that you have a good track record with respect to loan. Therefore if your credit score is high (more than 750 in case of CIBIL). Your chance of being granted a loan is much more. Additionally, you may able to negotiate benefits such as lower interest rate, higher loan amount, waiver of processing charges, etc. by showing your high credit score.

Yes, though the exact amount varies from one bank to another bank. Most lender have set their minimum personal loan principal amount at Rs. 30,000.

The bank will levy certain ECS bounce charges/penalties. In addition it will get reported in your credit report. Depending on the severity of the default, it can have serious impact on your future credit possibilities like car loan, education loan etc. In addition, the banks can also take legal action against the borrower.